About

Secondary MedWhat is Secondary Med?

Secondary Med is a customizable supplemental health program that complements a group comprehensive major medical plan. Secondary Med is not a replacement for your primary coverage, but rather a supplement to your primary carrier’s health plan. Simply put, Secondary Med pays the member’s portion of an eligible medical claim (i.e., copays, deductibles, and coinsurance) up to annual maximum benefit. Benefits are may be directly to the healthcare providers upon submission of the patient’s Itemized Bill or HCFA and the Primary Carrier’s EOB.

By reducing the claims risk to the primary insurer, employers experience immediate savings and greater premium stability going forward. By providing an additional layer of protection for your employees, Secondary Med also reduces the employee’s risk to out-of-pocket expenses. This combination makes Secondary Med one of the few employee benefits that can be mutually beneficial to all parties.

By reducing the claims risk to the primary insurer, employers experience immediate savings and greater premium stability going forward. By providing an additional layer of protection for your employees, Secondary Med also reduces the employee’s risk to out-of-pocket expenses. This combination makes Secondary Med one of the few employee benefits that can be mutually beneficial to all parties.

In addition, Secondary Med can provide numerous advantages within Healthcare Reform compliance, including reducing the burden of complying with the “ACA Affordability Clause,” all the while strengthening ones health plan.

Claims Process

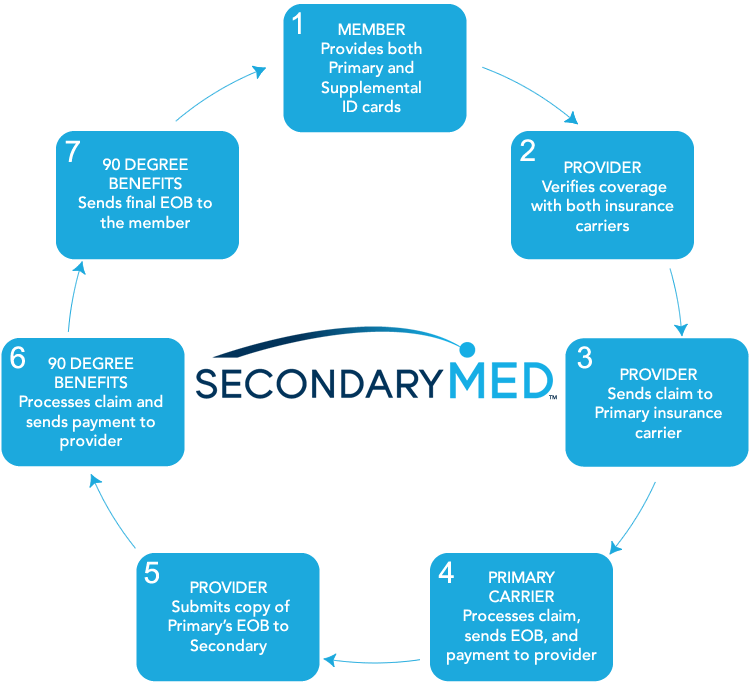

One of the unique advantages of Secondary Med is that healthcare providers are able to file all of the claims for patients via an electronic payer code that is clearly labeled on the member’s secondary insurance card (note providers can also file US mail). Here is how the claims process works:

At 90 Degree Benefits, we believe the right health plan does more than just provide benefits – it takes your business in the right direction.

Whether you’re looking to transition from being fully insured, or are interested in self-funding with a new plan administrator, 90 Degree Benefits has the experience, tools and unparalleled industry expertise to take your plan in the right direction.

We deliver health plans built on uniquely crafted benefits designed specifically for the needs of our clients all across the country.

It’s time to experience a health plan that helps you along your road to success. Make the right turn with 90 Degree Benefits.

Alarming Healthcare Statistics

U.S. Bankruptcies

- 62% of U.S. individual bankruptcies are due to medical bills and most of those who filed for bankruptcy were middle-class, well-educated homeowners. 92% of these medical debtors had medical debts totaling less than 10% of pretax family income. (Source: The American Journal of Medicine.)

- 78% of these individuals that filed for bankruptcy due to medical bills had health insurance. (Source: The American Journal of Medicine.)

Out-of-Pocket Costs

Out-of-Pocket Costs

Annual out-of-pocket responsibility for families covered by employer-sponsored health insurance in 2012 was $4,316. (Source: The 2012 Employer Health Benefits Survey, the Kaiser Family Foundation and the Health Research and Educational Trust (HRET), September 2012.)

Deductibles

- Nearly 30% of privately insured, working-age Americans with deductibles of at least 5% of their income had a medical problem but didn’t go to the doctor. Around the same percentage skipped doctor-recommended medical tests, treatments or follow-ups. (Source: Commonwealth Fund)

- The percentage of covered workers in a plan with a deductible of at least $1,000 for single coverage grew from 31 percent to 34 percent in the past year. Covered workers in small firms remain more likely than covered workers in larger firms (49 percent vs. 26 percent) to be in plans with deductibles of at least $1,000. (Source: The 2012 Employer Health Benefits Survey, the Kaiser Family Foundation and the Health Research and Educational Trust (HRET), September 2012.)

Average Recovery Rates

- Hospitals – 11.3 percent. (Source: ACA International’s Top Collection Markets Survey*, Jan. 1 – Dec. 31, 2012.)

- Non-hospitals – 16.7 percent. (Source: ACA International’s Top Collection Markets Survey, Jan. 1 – Dec. 31, 2012.)

Uncompensated Care/Bad Debt

U.S. hospitals provided $41.1 billion in uncompensated care in 2011, representing 5.9 percent of annual hospital expenses. (Source: American Hospital Association, “Uncompensated Hospital Care Cost Fact Sheet,” January 2013.)

The national average for bad debt is 3.17 percent, 2.21 percent for charity and 5.38 percent for total uncollectable accounts. The Southeast region of the U.S. had the highest percentage of total uncollectable accounts at 6.70 percent. (Source: The Hospital Accounts Report Analysis on Fourth Quarter 2012.)

Underinsured

• As of 2012, 75 million people reported problems paying their medical bills or were paying off medical debt, up from 73 million in 2010 and 58 million in 2005. An estimated 48 million people were paying off medical debt in 2012, up from 44 million in 2010 and 37 million in 2005. (Source: Press release, The Commonwealth Fund, April 26, 2013.)

Premiums

In 2012, annual premiums for families covered by employer-sponsored health insurance averaged $15,745. Premiums rose 4 percent since 2011, but have risen 97 percent since 2002. (Source: The 2012 Employer Health Benefits Survey, the Kaiser Family Foundation and the Health Research and Educational Trust (HRET), September 2012.)

Cost of Care

In 2010, 41 percent of adults (ages 19-64) reported that they had medical debt or trouble paying medical bills, and 22 percent had been contacted by a collection agency for unpaid medical bills. (Source: The Commonwealth Fund Biennial Health Insurance Survey 2012, April 2013.)

Access to Care

In 2012, 43 percent of adults, or 80 million people, said they had skipped or delayed getting needed health care or filling prescriptions because of the cost. This is an increase from 75 million people who reported such problems in 2010, and 64 million in 2005. More than a quarter (28 percent) of adults with a chronic health condition said they had skipped doses or not filled a prescription for their health condition because of the cost. (Source: The Commonwealth Fund Biennial Health Insurance 2012, April 2013.)

Frequently Asked Questions

What is Secondary Med?

Secondary Med is a supplemental health insurance program that pays the member’s cost sharing portion of a qualified medical service (i.e., copays, deductibles, and coinsurance).

Who files and pays the claims?

The medical providers file all of the claims. Members simply have an additional ID card that allows providers to file claims electronically on their behalf and be paid directly by the insurance company.

Is Secondary Med intended to replace my current health plan or provider?

No. It is NOT intended to replace your current provider or health plan, but rather it works in conjunction with any plan or provider in the marketplace.

Is Secondary Med a HSA, FSA, or HRA plan?

No, but Secondary Med is similar to those plans in that it is funded with pretax dollars and pays for members’ out-of-pocket medical expenses. However, with HSA’s, FSA’s, and HRA’s, for every $1 you contribute you have $1 of benefit, where as Secondary Med funding operates on a premium to leverage your dollars into a larger benefit.

How is Secondary Med affected by the PPACA (||Obamacare||)?

Will Secondary Med increase the cost of our health insurance?

No. Even with the additional Secondary Med premium, your overall health premiums should go DOWN!

Are preexisting conditions excluded?

Who underwrites and administers Secondary Med?

Secondary Med is administered by 90 Degree Benefits, the Group Supplemental Medical Expense Policy, is underwritten by ACE American Insurance Company, a member of the Chubb Group of insurance companies.

What is needed for an initial analysis?

(1) Current Summary of Plan Description;

(2) Current rates;

(3) Census of employees on your plan;

(4) Amount of HSA, HRA, or FSA employer contributions (if any);

(5) A meeting with one of our Benefits Consultants.