Provider Services

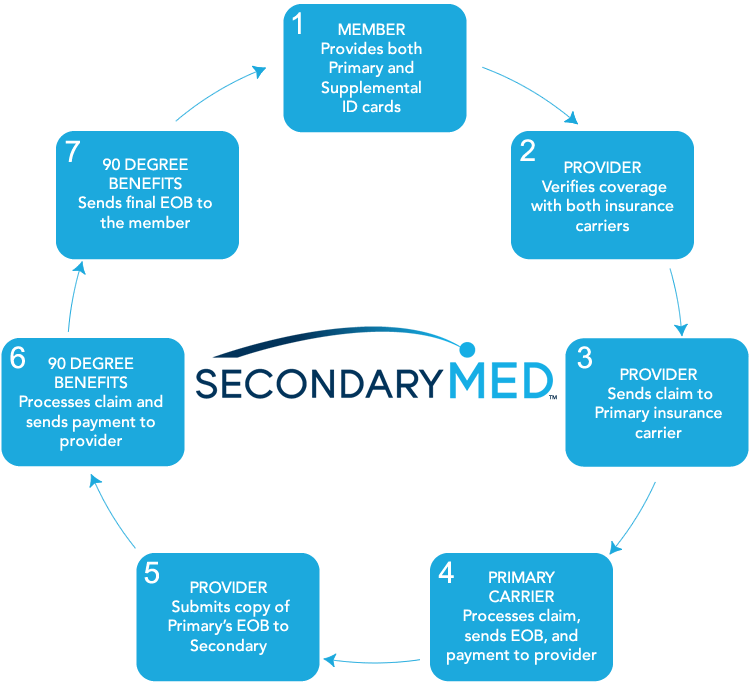

Secondary MedClaim Filing

Provider Verifying Coverage

90 Degree Benefits Phone Number:

(800) 239-3503

US Mail Claims Submissions

90 Degree Benefits

2810 Premiere Pkwy, Suite 400

Duluth, GA 30097

or FAX to: (678) 258-8299

Provider Must Include

- Itemized Bill or HCFA Form

- Copy of Primary Carrier EOB

EDI Claims Submission

Clearing House:

ChangeHealthcare

Payor ID: 58102

Claim Process

Provider Portal

Click the button below to verify coverage or register to the provider portal:

Benefits to Providers

For services eligible under the patients’ primary health insurance, Secondary Med pays the patients’ out-of-pocket expenses such as copays, deductibles, and coinsurance. Claims are paid directly to the healthcare provider via our third party administrator 90 Degree Benefits. Secondary Med provides many benefits to healthcare providers such as, but not limited to:

- Timely direct deposit payments.

- Reduction in Accounts Receivable.

- Reduction in the volume patient services that are delayed or avoided.

- Reduction in bad debt.

- Increase in patient utilization.

- Improvement in patient’s physical and financial wellbeing.

Frequently Asked Questions

How do I file a claim?

First, a claim for services performed must be filed with patient’s primary insurance provider. Once the healthcare provider receives the Primary Carrier EOB, they may then submit the claim via electronically filing, by fax, or by mail. For claim adjudication, filings must include a copy of the Primary Carrier’s EOB.